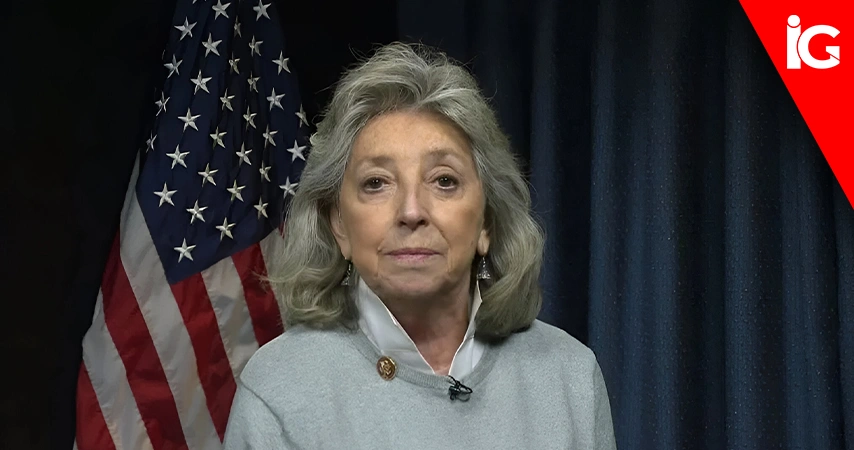

Congresswoman Dina Titus of Nevada has introduced her FAIR BET Act as an amendment to the 2026 National Defense Authorization Act, reviving the push to restore the 100% deduction on gambling losses. The change comes after last year’s One Big Beautiful Bill Act capped deductions at 90%, sparking backlash from both lawmakers and the U.S. gaming industry. Critics argue the cap taxes players on “phantom income,” forcing them to pay on winnings even when losses cancel them out.

The FAIR BET Act has bipartisan support, with multiple companion bills in Congress and backing from industry leaders, tribal governments, and Nevada’s governor. By attaching her measure to the must-pass defence bill, Titus aims to accelerate action before the rule takes effect in 2026. Industry leaders and lawmakers alike warn the cap undermines fairness, trust, and compliance in the gambling tax system.